Join our training program on Sales Tax Returns Filing and learn how to easily file your sales tax returns online. Our program will cover everything you need to know, including:

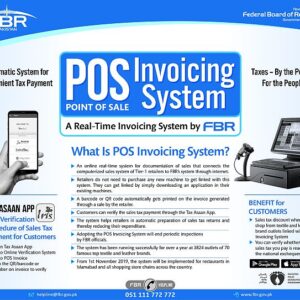

- Understanding sales tax laws and regulations

- Navigating the online filing system

- Filling out and submitting your returns correctly

- Avoiding common mistakes and penalties

Our expert trainer will guide you through the process step-by-step, providing you with practical tips and best practices for efficient and accurate filings of sales tax return.

Don’t miss this opportunity to streamline your sales tax filings and improve your business operations.

Who should attend?

The training program on sales tax online return filing is ideal for business owners, managers, and finance professionals who are responsible for sales tax compliance and filing returns. This program is suitable for businesses of all sizes and across all industries, including:

- Small business owners: Owners of small businesses who are responsible for managing their own sales tax filings would greatly benefit from this training program to ensure compliance with tax laws and regulations.

- Finance professionals: Financial professionals, such as accountants, bookkeepers, and sales tax preparers, who are responsible for managing the sales tax filings for their clients can benefit from this program to ensure they are equipped with the latest knowledge and skills.

- Managers: Managers who oversee finance and accounting departments or are responsible for ensuring compliance with income tax laws within their organization would also benefit from attending this training program.

- New hires: New employees who are responsible for managing sales tax filings within a business would also benefit from this program to get up to speed with the latest tax laws and regulations, and to ensure they are properly trained on the online filing system.

In summary, anyone who is responsible for managing sales tax return filings for a business or organization, or who wants to learn more about tax compliance and the online filing system, should attend this training program.

30 days free consultancy Bonus for the participants:

As an added bonus, participants who attend this program will receive 30 days of free consultancy services from the trainer. This free consultancy period will provide participants with the opportunity to receive additional guidance and support as they implement what they have learned during the training program.

During the 30-day consultancy period, participants will have access to the trainer for guidance and support on sales tax compliance issues and online filing questions. This service is particularly useful for participants who may have unique or specific needs related to their business operations, or who may encounter challenges when implementing the training program’s strategies and best practices.

The consultancy services will be tailored to each participant’s specific needs, and may include:

- One-on-one consultations with the trainer to discuss specific questions or concerns related to sales tax compliance or online filing.

- Assistance with navigating the online filing system or resolving technical issues related to the online filing process.

- Guidance on best practices for maintaining accurate records and managing sales tax compliance.

- Assistance with identifying and addressing areas of risk or concern related to sales tax compliance.

Overall, the 30-day free consultancy period is an excellent opportunity for participants to receive personalized guidance and support from an expert in the field of sales tax compliance and online filing. By taking advantage of this bonus service, participants can ensure they are fully prepared to implement what they have learned and maintain compliance with sales tax regulations going forward.